Limits on your Pension

Current legislation limits the amount of money you can save in registered pension scheme arrangements. The limits are applied to both how much you pay each year (the Annual Allowance) and how much your total pension savings are valued at (the Lifetime Allowance). If you exceed either of these limits you may be liable for additional tax.

Annual Allowance

The Annual Allowance (AA) is a limit on the amount of pension benefits you can build up each tax year without incurring a tax charge. Currently the AA for most members is £60,000. If your total taxable earnings is in excess of £200,000 or you have taken benefits in this tax year from another pension arrangement your AA may be reduced. Please see the notes below for more information.

Your Annual Benefit Statement will show how much of your AA you have used building up your pension in the BAA Pension Scheme.

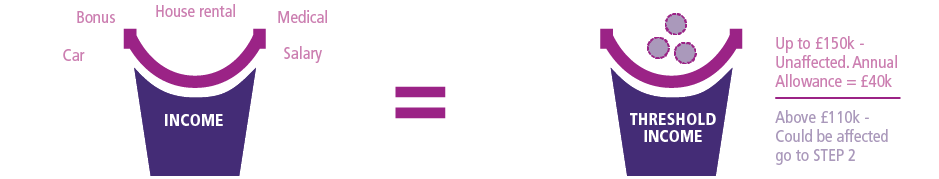

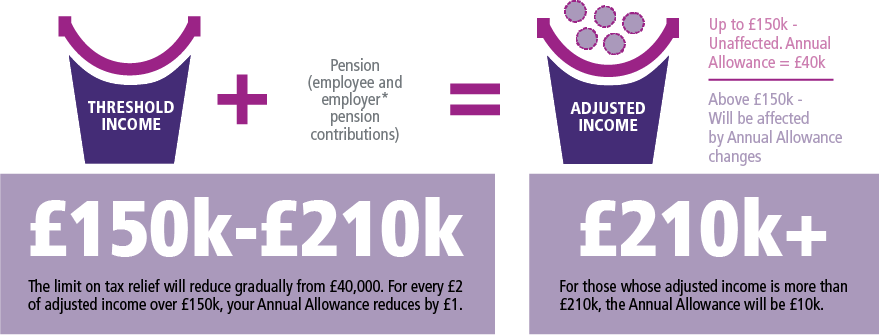

My income is more than £200,000

If your income is more than £200,000 you may be subject to the new tapered Annual Allowance.

To find out if you are affected go through the following two steps:

Step 1 – £200,000 check

Step 2 – £200,000+ check

I have taken benefits from another pension scheme this year

If you have taken benefits from a Defined Contribution arrangement your Annual Allowance may be automatically reduced to £10,000. This will depend on how you took your benefits. If you think you may be affected by this, you should contact the Administration team.

Lifetime Allowance

The Lifetime Allowance (LTA) was a limit on the amount of all your pension benefits (excluding your State Pension) that you can accumulate during your working life without incurring an additional tax charge.

From 6 April 2024, the Lifetime Allowance (LTA) which sets the total value of all the pension savings you can build up before having to pay extra tax, is being abolished. The limit of cash members can take will remain the same.

From 6 April 2023, the LTA charge has been removed, so there will be no additional tax charge from this date.

The amount of tax-free lump sum you can take is 25% of your total pension savings up to a maximum of 25% of the standard lifetime allowance. The amount of pension you’ve built up is usually expressed as a percentage of the LTA. You will need to add all the percentages from your different pension providers to identify if you exceed the LTA.

The LTA percentage you have used up in the Scheme will be shown on your Annual Benefit Statement.